Based on the Following Data, What Is the Quick Ratio, Rounded to One Decimal Point?

There are numerous accounting ratios that can be used to determine the financial stability and credit-worthiness of your company.

One of those, the quick ratio, shows the rest between your current assets and your electric current liabilities, with the best issue showing that current company assets outweigh current liabilities. Yous'll remember from Accounting 101 that assets are annihilation you ain and liabilities are anything you owe.

While your bookkeeper or staff auditor tin can certainly summate a quick ratio, information technology'southward best to let an experienced accountant provide the follow-upwardly assay on what the quick ratio results mean for your company.

Overview: What is the quick ratio?

The quick ratio, besides referred to as the acrid-test ratio, is considered a liquidity ratio. The quick ratio definition is simple: it calculates and measures the ability of your company to pay its current liabilities and debts.

The quick ratio is called such considering it only measures liquid assets, or assets that can be quickly converted into cash. Yous will demand to be using double-entry accounting in lodge to run a quick ratio.

What is a good quick ratio?

The college your quick ratio, the better your concern will be able to see whatever short-term financial obligations. A quick ratio of i ways that for every $1 in current liabilities, you take $ane in current assets.

If the quick ratio for your business is less than 1, information technology ways that your liabilities outweigh your avails, while a quick ratio of 10 means that for every $ane in liabilities, you have $10 in liquid assets.

What'southward the difference between the quick ratio vs current ratio?

While both the quick ratio and the current ratio carve up assets past liabilities, they differ in the types of assets included in each formula:

- Quick ratio: The quick ratio formula uses electric current liquid avails, which are assets that tin can exist turned into greenbacks quickly, divided by current liabilities. The quick ratio does not include inventory, prepaid expenses, or supplies in its adding.

- Current ratio: The current ratio formula is current assets divided by current liabilities, simply information technology includes all electric current assets, not simply liquid assets.

This is an important difference when it comes to determining the ability of your company to pay its short-term liabilities, which is what the quick ratio is designed to do.

The quick ratio formula

Y'all will use a balance canvas in order to calculate the quick ratio.

You tin can obtain all the data you demand to run the quick ratio from your balance canvass.

The quick ratio formula is:

(Cash + Marketable Securities + Accounts Receivable) ÷ Current Liabilities = Quick Ratio

Marketable securities are financial instruments that can be rapidly converted to cash, such every bit government bonds, common stock, and certificates of eolith.

Other assets are excluded from the formula since it calculates your ability to pay debts short-term, so the formula is merely concerned with avails that accept liquidity.

Current liabilities are short-term debt that are typically due within a year. You should include only current liabilities in your adding for the same reason listed higher up; the formula is designed to calculate the ability to pay debts short-term.

How to calculate the quick ratio

If y'all're still confused about how to calculate the quick ratio, nosotros'll take you through the procedure step-by-step.

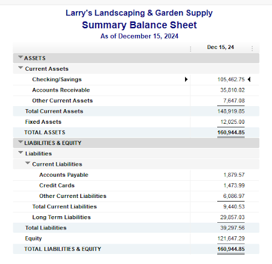

Step 1: Run a residue canvas

The nigh important step in the procedure is running your residual sheet, since you lot will exist pulling all of your numbers from the balance sheet in order to calculate the quick ratio.

Pro Tip: Information technology'due south best to run a standard balance sheet, rather than a summary balance canvas, since the standard balance sheet provides both nugget and liability details rather than only totals.

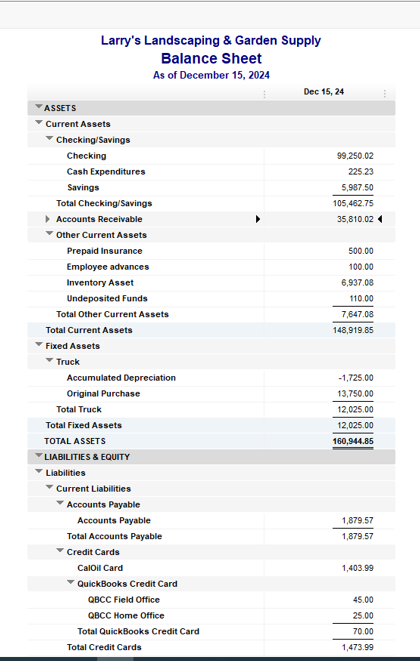

Footstep ii: Calculate your electric current assets

Recollect, while you want to include current assets in your quick ratio, yous only desire to include liquid assets.

The standard rest sheet provides nugget details.

Liquid assets include your cash and accounts receivable, besides equally undeposited funds. You would non include inventory or prepaid expenses in the quick ratio adding, as neither tin can be converted to cash quickly. To calculate your electric current avails y'all will add the following:

| Full Checking/Savings: | $105,462.75 |

| Accounts Receivable: | $ 35,810.02 |

| Undeposited Funds: | $ 110.00 |

| Total liquid assets | $141,382.72 |

You lot would non include prepaid insurance, employee advances, and inventory avails since none of those items tin be apace converted to cash.

Pro Tip: Be sure to only include assets that can be quickly converted to greenbacks when calculating the quick ratio.

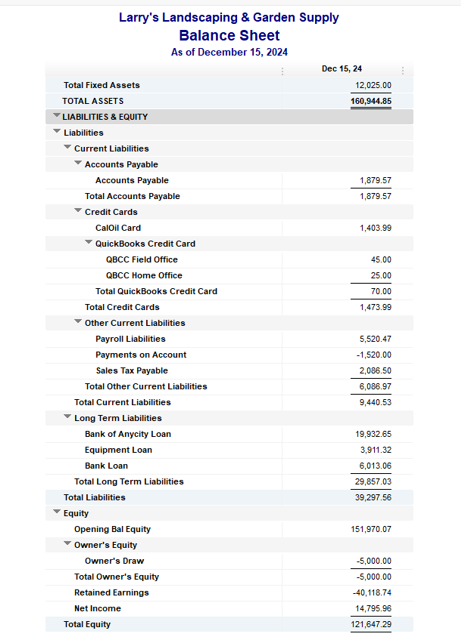

Pace 3: Calculate your current liabilities

Like your assets, y'all'll just desire to include your current liabilities when computing the quick ratio.

Only current liabilities should be included in the quick ratio calculation.

Current liabilities include accounts payable, credit bill of fare debt, payroll, and sales tax payable, which are all payable within 1 year. To run the quick ratio, you can employ your full current liabilities based on the balance sheet above, which is $nine,440.53. Long term liabilities should exist excluded.

Pro Tip: Be sure to exclude long term liabilities such every bit bank loans when calculating the quick ratio.

Step 4: Consummate the quick ratio calculation

Using the balance sheet totals displayed in Step 2 and Pace 3, the numbers y'all will use to summate the quick ratio are as follows:

Current assets: $141,382.77 (Step 2)

Electric current liabilities: $9,440.53 (Step 3)

Yous tin now summate the quick ratio:

$141,382.77 ÷ $9,440.53 = 14.98

Pro Tip: Double check your numbers to ensure that only current, liquid avails and current liabilities are included in the quick ratio calculation.

How can your visitor use your quick ratio?

Knowing the quick ratio for your visitor tin can help you brand needed adjustments such every bit increasing sales, or developing a more effective accounts receivable collection process.

Knowing the quick ratio can too help when you're preparing financial projections, no matter what type of accounting your company currently uses.

Quick ratio can help your company

The quick ratio meaning is simple: does your company have enough current assets to encompass its current liabilities. Calculating this ratio can be particularly valuable for those looking to obtain additional financing, as both creditors and investors will want to see how financially stable your company is before lending coin.

Finally, if you're not happy with the results of the quick ratio, you lot tin can take steps internally to begin to address the issues that may be causing a low quick ratio, such as the disability to collect on accounts receivable on a timely ground.

Like any ratio, the quick ratio is more benign if it'due south calculated on a regular basis, so you tin determine whether your number is going up down, or remaining the same.

An accurate balance sheet is the cardinal to an accurate quick ratio. If you're looking for accounting software to help prepare your financial statements, exist sure to cheque out The Blueprint'south accounting software reviews.

Quick ratio oftentimes asked questions

Why is it beneficial for my company to calculate the quick ratio?

The quick ratio lets you lot know if your company has plenty current, liquid avails to pay its short-term debts.

What does the quick ratio number mean?

The quick ratio number is a ratio between assets and liabilities. For case, a quick ratio of 1 ways that for every $1 of liabilities you have, you accept an equal $ane in avails. A quick ratio of 15 means that for every $1 of liabilities, you have $15 in assets.

What tin I do if my number is as well low?

If your quick ratio number is too low, you lot can reexamine company policies, work to increment sales, or institute better drove practices so you can be paid on a more timely basis.

The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an involvement in companies mentioned.

easterlingforer1944.blogspot.com

Source: https://www.fool.com/the-blueprint/quick-ratio/

0 Response to "Based on the Following Data, What Is the Quick Ratio, Rounded to One Decimal Point?"

Post a Comment